Carbon Credits: Canada's $33 Billion-Dollar Opportunity in the Post-Paris Agreement World

December 15, 2022

- COP27 has solidified the role that carbon credits will play in achieving the decarbonization goals under the Paris Rulebook.

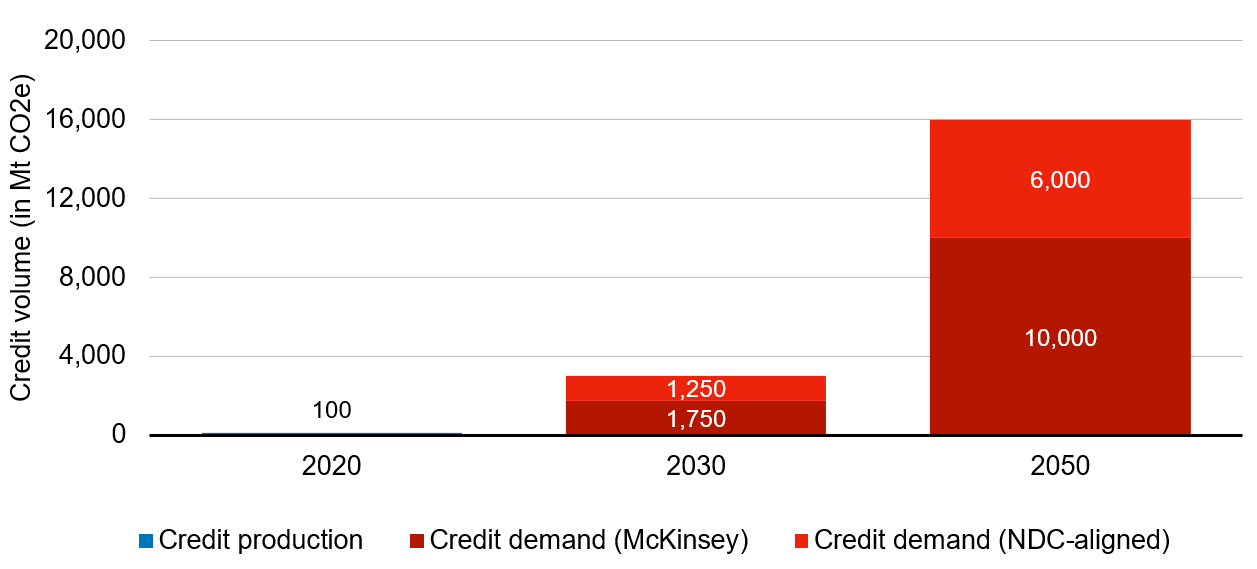

- The demand for carbon credits is expected to reach 1.7 GtCO2e (1.7 billion credits) by 2030 and 10 GtCO2 (10 billion credits) by 2050.

- Canada has the potential to become a major player in the global carbon credit market. If Canada can increase its production of carbon credits to meet this demand, it could become the second-largest export commodity by value in the country, worth an estimated CA$33 billion in annual exports This would position Canada as a carbon credit superpower and play a critical role in achieving a net-zero world.

Written by: David Oliver, Head of Carbon, DevvStream Inc.

Date: December 9th, 2022

Canada is a vast country with abundant natural resources, making it one of the world's leading exporters of key commodities such as petroleum products, grains, potash, and forestry products. These exports play a vital role in the global economy, powering industry, feeding the world, and keeping it running smoothly. The billions of dollars generated by these exports are what sustains the Canadian way of life, funding key aspects of society such as healthcare, education, transportation, and the military.

However, the world is rapidly transitioning towards a low-carbon future, with a goal of achieving net-zero emissions by 2050. As a result, demand for fossil fuels such as oil and gas is decreasing, presenting a significant challenge for Canada, which relies heavily on the export of these commodities. To maintain its economic stability and global influence, Canada will need to find new commodities to export, and one potential option is carbon credits.

The recent COP27 summit in Egypt highlighted the growing importance of carbon markets, with a strong demand for high-quality, high-environmental integrity carbon credits from both corporations seeking carbon neutrality and countries looking to meet their decarbonization targets. The Paris Agreement, which was adopted in 2015, includes provisions for the use of "market-based mechanisms" to meet reduction targets, including the use of carbon credits.

Countries such as Switzerland and Singapore have already signed carbon credit deals with other nations, and Japan is leading the "Paris Agreement Article 6 Implementation Partnership" with 60 other countries to explore the use of carbon credits. Canada could follow a similar approach, leveraging its expertise in commodity trading and its abundant natural resources to become a major player in the global carbon credit market.

The potential demand for carbon credits is significant. According to a study by McKinsey, global demand for carbon credits is expected to reach 1.7 GtCO2e (1.7 billion credits) by 2030 and 10 GtCO2 (10 billion credits) by 2050. In order to meet the reduction targets set in the Paris Agreement, the world must reduce its emissions by approximately 25 GtCO2e by 2030 and 35 by 2050. It is estimated that half of these reductions will come from more stringent regulations, operational efficiencies, and carbon taxes, while the other half will come from carbon markets. If we assume that 75% of carbon credits will come from regulated (compliance) markets and 25% from voluntary markets, then we can expect an unprecedented demand for voluntary carbon credits in the range of 3 billion credits by 2030 and over 4 billion by 2050, in excess of McKinsey’s estimates.

Canada has the potential to supply a significant portion of this demand, given its abundant natural resources and existing infrastructure for trading commodities. For example, Canada's forests cover almost half of the country and are a major source of carbon sequestration, with the potential to generate millions of carbon credits. The country also has significant potential for renewable energy generation, with vast reserves of hydroelectricity, wind, and solar power.

To capitalize on these opportunities, Canada will need to develop its carbon credit market and establish partnerships with other countries. This could involve implementing carbon pricing mechanisms, such as a cap-and-trade system, to provide incentives for reducing emissions and generating voluntary carbon credits. It could also involve partnering with other countries to develop joint carbon credit projects, such as forest conservation or renewable energy generation.

Canada could also use its position as a member of the G7 to advocate for the use of carbon credits in global climate policy. The G7 is a group of seven major advanced economies that meet annually to discuss global economic issues, and Canada has traditionally played a key role in promoting the use of market-based mechanisms to address climate change. By advocating for the use of carbon credits in global climate policy, Canada could help to drive demand for these credits and position itself at the forefront of this new emerging commodity that will power the Paris Agreement.

According to McKinsey, approximately 95 MtCO2e (95 million carbon credits) were retired by organizations in 2020. While there are no official figures on global credit production, it is safe to assume that production has hovered around 100 million credits in recent years. In order to meet the projected demand for carbon credits, global credit production must increase from 100 million credits today to 3 billion in just 7 years.

The largest global suppliers of carbon credits are India, Brazil, China, Indonesia, and to a lesser extent, the United States. Africa and South East Asian countries are also increasing their contributions to the world's supply of carbon credits, although their contributions remain minor. Canada, on the other hand, produces a small number of carbon credits, and most of these are for local consumption by Canadian-based organizations to offset their emissions, rather than being exported.

So, to recap:

- Global production of voluntary carbon credits was ~ 100 million in 2020, twice the volume of 2019.

- Most of the global credit production is currently in the hands of a handful of developing countries, and Canada plays an insignificant role.

- Global demand for voluntary carbon credits by 2030 is expected to reach 1.7 billion credits (McKinsey), or ~3 billion credits (if countries are to meet their NDCs).

To generate large quantities of carbon credits, Canada could take several steps, including:

- Shift to renewable energy sources: By moving away from coal and natural gas-based power generation and towards renewable sources such as hydro, nuclear, wind, and geothermal power, Canada could reduce its emissions and generate significant quantities of carbon credits. For example, each megawatt of renewable power could generate 2,000-3,000 carbon credits when replacing coal or natural gas-based electricity. By replacing all non-renewable power in Canada with renewable sources, the country could generate millions of credits annually.

- Plug abandoned oil wells: Methane, which is emitted from abandoned oil wells, has a global warming potential 32 times that of carbon dioxide. Approximately 10% of abandoned and orphaned oil wells are classified as "super emitters," meaning that they emit over 3,000 tons of CO2 equivalent per year. With an estimated 700,000 abandoned and orphaned oil wells in Canada, plugging these super emitters could generate over 200 million carbon credits annually.

- Implement energy efficiency measures: By implementing energy efficiency measures in residential, commercial, and institutional buildings across the country, Canada could reduce the demand for energy generation, improve the health of Canadians, and generate significant quantities of carbon credits. Examples of energy efficiency measures include heat pumps, LED lighting, high-efficiency HVAC units, building controls, and improved building envelopes.

- Switch to lower-carbon fuels: By switching to lower-carbon fuels in transportation and industries, Canada could reduce emissions and generate carbon credits. Transportation alone accounts for approximately 30% of Canada's 640 million tons of emissions per year, or roughly 192 million tons. By moving away from fossil fuels and towards electrification or other low-carbon fuels, Canada could reduce its emissions by an estimated 30-40%, generating approximately 65 million carbon credits per year.

- Use carbon sequestration in forestry and agriculture: With its vast forests and agricultural lands, as well as its coastline spanning three oceans, Canada is well-positioned to become a global leader in carbon sequestration. By protecting and expanding its forests, promoting sustainable agriculture practices, and developing seaweed/kelp plantations, Canada could both protect the environment and generate hundreds of millions of carbon credits. Estimating the potential for carbon sequestration in nature-based systems is challenging, but given Canada's size and natural resources, it is likely to be in the hundreds of millions of tons.

- Deploy carbon capture and storage/utilization technologies: Advances in carbon capture and storage/utilization technologies have made it possible to sequester carbon at scale, and as these technologies continue to mature, their costs will likely decrease. Canada could demonstrate global leadership by enabling the deployment of cross-country facilities to capture and store/use GHG emissions, generating millions of carbon credits in the process. While this is still a nascent sector, it is estimated that facilities capable of capturing 5-10 million tons of emissions per year could be operational by 2030. Deploying ten such facilities could generate 50-100 million carbon credits per year.

According to Canada's 2030 Emissions Reduction Plan, the country aims to reduce its emissions by 40% below 2005 levels by 2030, equivalent to approximately 300 million tons of CO2e. This reduction could be achieved through the use of carbon credits, which would represent around 17% of global credit demand by 2030. However, carbon sequestration is not limited by jurisdictional boundaries, so facilities in Canada could sequester carbon from the atmosphere regardless of where the emissions were generated. Protecting and enhancing forests, supporting farmers in implementing soil sequestration activities, and developing large-scale carbon capture facilities could generate millions of carbon credits from GHG emissions emitted in Canada and elsewhere.

If 50% of the potential activities described above were implemented, Canada could generate up to 400 million carbon credits per year by 2030, representing 22.8% of global demand (1,750 GtCO2e, according to McKinsey). The value of these carbon credit exports would need to be determined, but it is likely that they would be competitive with Canada's other commodity exports such as oil and gas, grain, etc.

To determine the value of carbon credit exports from Canada, we must first establish the price per credit, typically expressed in dollars per ton of CO2e avoided or removed. According to the IPCCC, the World Bank, and others, the price of carbon credits must average between $40 and $80 per ton in order to achieve the decarbonization goals set in the Paris Agreement. Assuming an average price of $60 per ton by 2030, which is lower than the $170 per ton set by the Canadian government for the federal carbon tax, and a production of 400 million credits per year, this would represent a total of $24 billion in export value, equivalent to approximately $33 billion Canadian dollars. This would make carbon credits the second-largest export commodity in terms of value, behind only crude petroleum ($39.5 billion), and ahead of all other commodities including gold ($12.5 billion), wheat ($4.5 billion), and aluminum ($5.04 billion).

———————

Canada has the potential to become a major force in the global carbon credit market. As the world moves towards achieving net-zero emissions by 2050, it is crucial for Canada to consider its role in this post-Paris Agreement world. The country can choose to become a net buyer of carbon credits, like Switzerland and Singapore, or it can position itself as a carbon credit superpower and play a critical role in achieving a net-zero world. The choice is ours to make, and the opportunity is within reach. It is vital for Canada's leaders to recognize the significance of this moment in history and take decisive action. Failure to do so could result in Canada falling behind in the race to decarbonize the global economy.